Zatca Approved E Invoice Solution Provider

Accounts Integrated with your Business Workflow

- +966 50 999 4081

Mail Us For Support

Office Address

Jubail 31951, KSA

Continuous development in the ever-changing small business world is predicated upon effective financial management. The invoicing process can be modernised through the use of electronic invoicing, or “e-invoicing,” which encourages accuracy, speed, and improved financial control. Small firms need to give smart e-invoicing software management first priority if they want to use this game-changing tool efficiently. The process starts with choosing an appropriate e-invoicing system that fits the particular requirements of the company. Next, automation is used to maximise efficiency and reduce errors in the billing procedure.

Financial data is protected by focusing security and maintaining fulfilment of tax requirements, although effectiveness and consistency are made better by interaction with accounting software. The payment cycle can be shortened up by providing a variety of payment methods, and accurate analytics tracking cash flow will provide priceless information for well-informed decision-making. Together, these seven pointers allow small firms to maximise e-invoicing’s possibility, simplify financial processes, and promote a successful future.

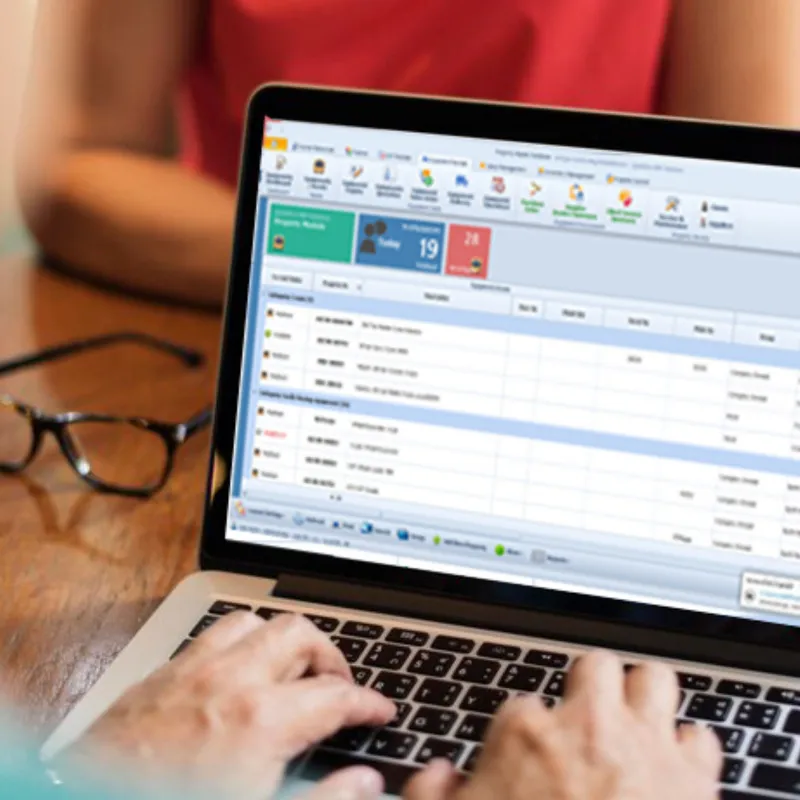

Businesses in Saudi Arabia’s capital city of Riyadh E-invoicing in Riyadh is gradually integrating the digital transformation wave, with particular focus on electronic invoicing (e-invoicing), which is made possible by modern software solutions. The ZATCA e-invoicing software is a well-known product in this field that can be identified by its feature-rich and simple interface.

Small and large businesses alike are improving their invoicing procedures and adjusting to the changing business landscape as a result of realising the efficiency gains and security benefits provided by ZATCA. The use of ZATCA e-invoicing software highlights the dedication of businesses in the region to modernise their financial workflows and contribute to the broader economic growth of the Kingdom, as Riyadh continues to establish itself as a hub for innovation and technical improvement.

1. Choose the Right E-Invoicing Software:

The first and most important step is choosing the appropriate e-invoicing software. Think on features like ease of accessibility, compatibility with your current systems (CRM, accounting, etc.), flexibility, and security features. Seek for software that fits your small business’s size and particular needs.

2. Prioritize User-Friendly Interfaces:

Choose software with a user experience that is easy to understand and manage. Your team’s process of learning has been reduced, and utilisation as a whole is improved. Additionally, less errors are made when creating and processing invoices when using user-friendly interfaces.

3. Ensure Compliance with Tax Regulation:

Keep yourself updated on local tax laws and requirements for compliance. Select electronic invoicing software that makes fulfilling these regulations simple. For the purpose of avoiding fines and keeping good financial status, conformity is essential.

4. Secure Your E-Invoicing System:

When processing financial transactions, security is essential. Make sure that strong security features are used by your e-invoicing software to safeguard private financial information. To protect yourself from potential security risks, look for features like encoding, safe access controls, and frequent software updates.

5. Integrate with Accounting Software:

Effective integration with your accounting programme improves productivity and lowers the possibility of data entry errors. It is now simpler to monitor and manage the financial health of your company thanks to this connection, which guarantees that financial data remains the same across all platforms.

6. Provide Multiple Payment Options:

Provide a variety of payment choices on your electronic invoices to speed up the payment process. Provide information on different payment options, including bank transfers, credit cards, and online payment services. Delays in payments can be greatly reduced by offering clients simple payment options.

7. Monitor Cash Flow and Analytics:

Make use of your e-invoicing software’s data analysis and reporting tools to keep eyes on cash flow, make financial reports, and record overdue payments. You can apply these insights to spot trends, manage your company’s finances actively, and make well-informed decisions.

Conclusion:

Adopting efficient procedures for managing e-invoicing software is essential for small firms that want to stay competitive in today’s fast-paced market and improve financial efficiency. Businesses can improve their invoicing processes and gain useful knowledge for making smart choices by following the seven top tips defined above, which include organising security, combining automation, ensuring regulation, and carefully selecting appropriate e-invoicing solutions. Adopting these best practices helps small businesses overcome challenges, maximise productivity, and flourish in an increasingly digital and connected company world. It also improves overall financial health and makes invoicing easier.

Comments are closed